7 Reasons to Own Your Home

1. Tax breaks. The U.S. Tax Code lets you deduct the interest you pay on your mortgage, your property taxes (limited to $10,000), as well as some of the costs involved in buying your home.

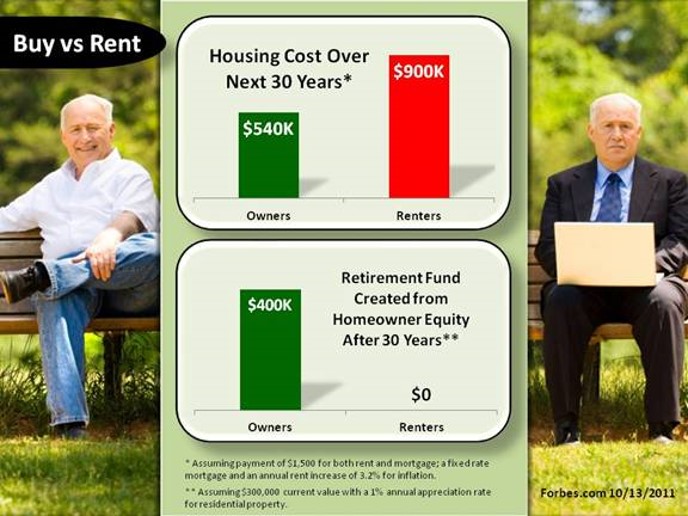

3. Equity. Money paid for rent is money that you’ll never see again, but mortgage payments let you build equity ownership interest in your home. Also, you can obtain a home equity line of credit for home improvements.

5. Predictability. Unlike rent, your fixed-mortgage payments don’t rise over the years so your housing costs may actually decline as you own the home longer. However, keep in mind that property taxes and insurance costs will increase. You can upgrade your home as you see fit!

6. Freedom. The home is yours, so, you can gain control over your living space. You can decorate any way you want and benefit from your investment for as long as you own the home. This provides you generate a sense of security and privacy.

7. Stability. No more need to move! Remaining in one neighborhood for several years gives you a chance to participate in community activities, lets you and your family establish lasting friendships, and offers your children the benefit of educational continuity.