2023 NVAR Mid-Year Market Economic Forecast

This is latest US & Washington DC Market Economic report which was presented on June 5, 2023 by: Dr. Terry Clower, Washington DC economist and head of Center for Regional Analysis at GMU; Kevin Stevens, Senior Manager, Mortgage Markets at the Consumer Financial Protection Bureau; and Michael Neal, Principal Research Associate at the Housing Finance Policy Center.

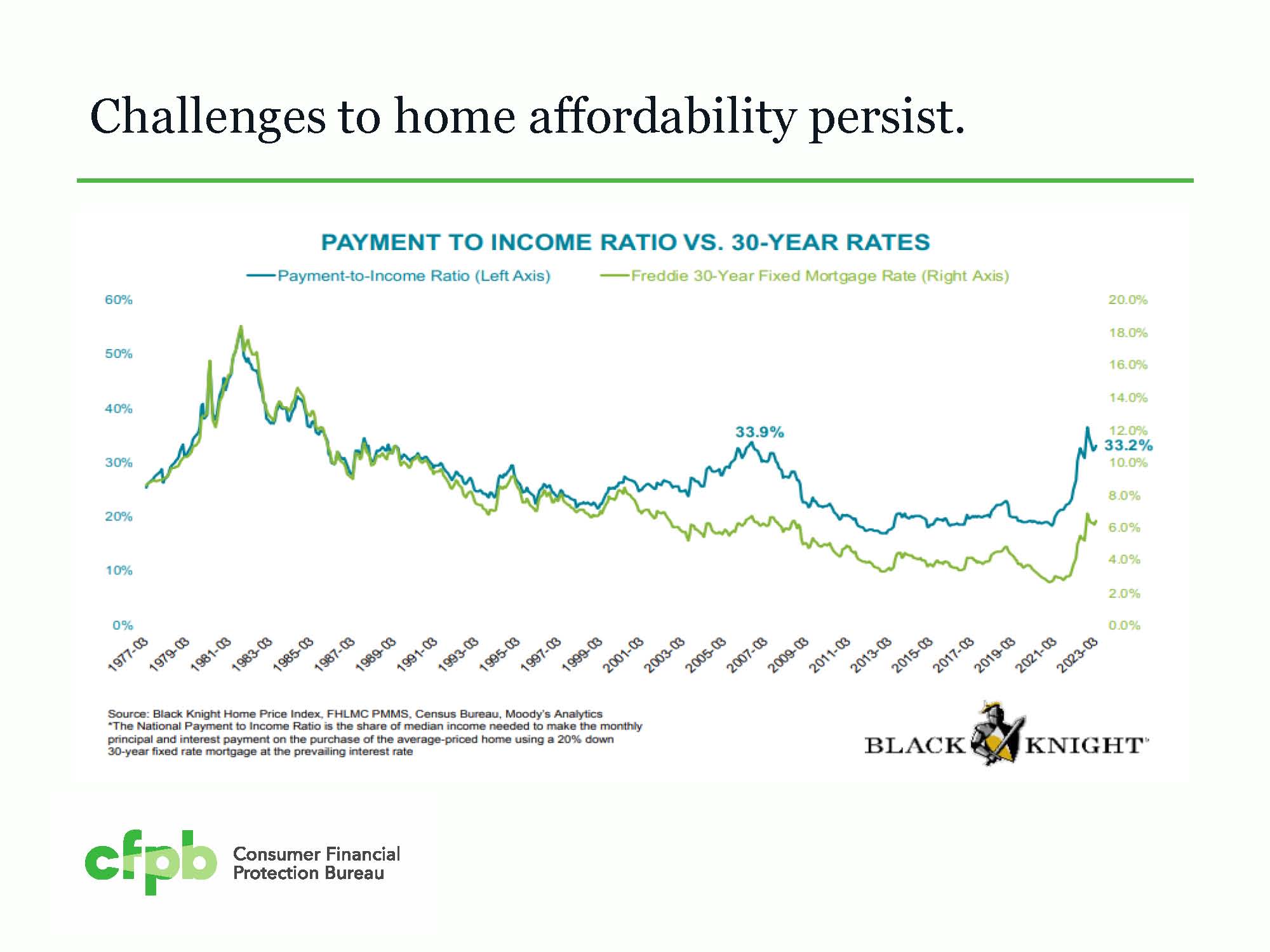

Long term high inflation during the late 1970s, caused mortgage interest rates to get into the double digits and as high as 18% in the early 1980s, which made monthly mortgage payments come to be about 50% of household income. For about 5 years we lived with 4% or less 30 year mortgage interest rates which caused affordability to increase dramatically. This in turn caused many people to either refinance, buy property or to upgrade. Mortgage interest rates climbed quickly in 2022, which caused many buyers to put purchasing plans on hold.

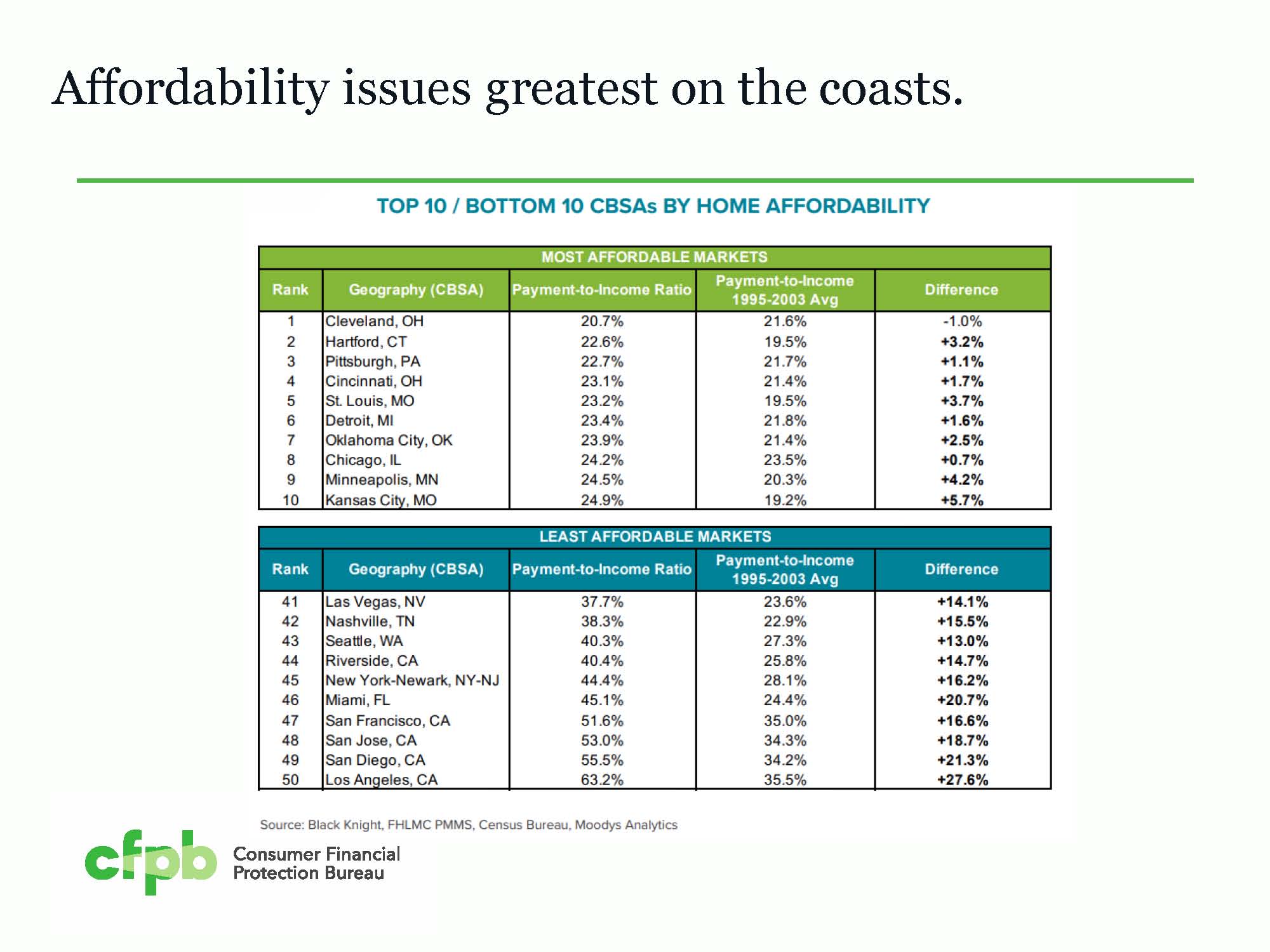

Although the DC region has fairly high prices, in relation to household income, it is not amongst the highest. Markets wherein home affordability have grown substantially may be poised for adjustment in the near future.

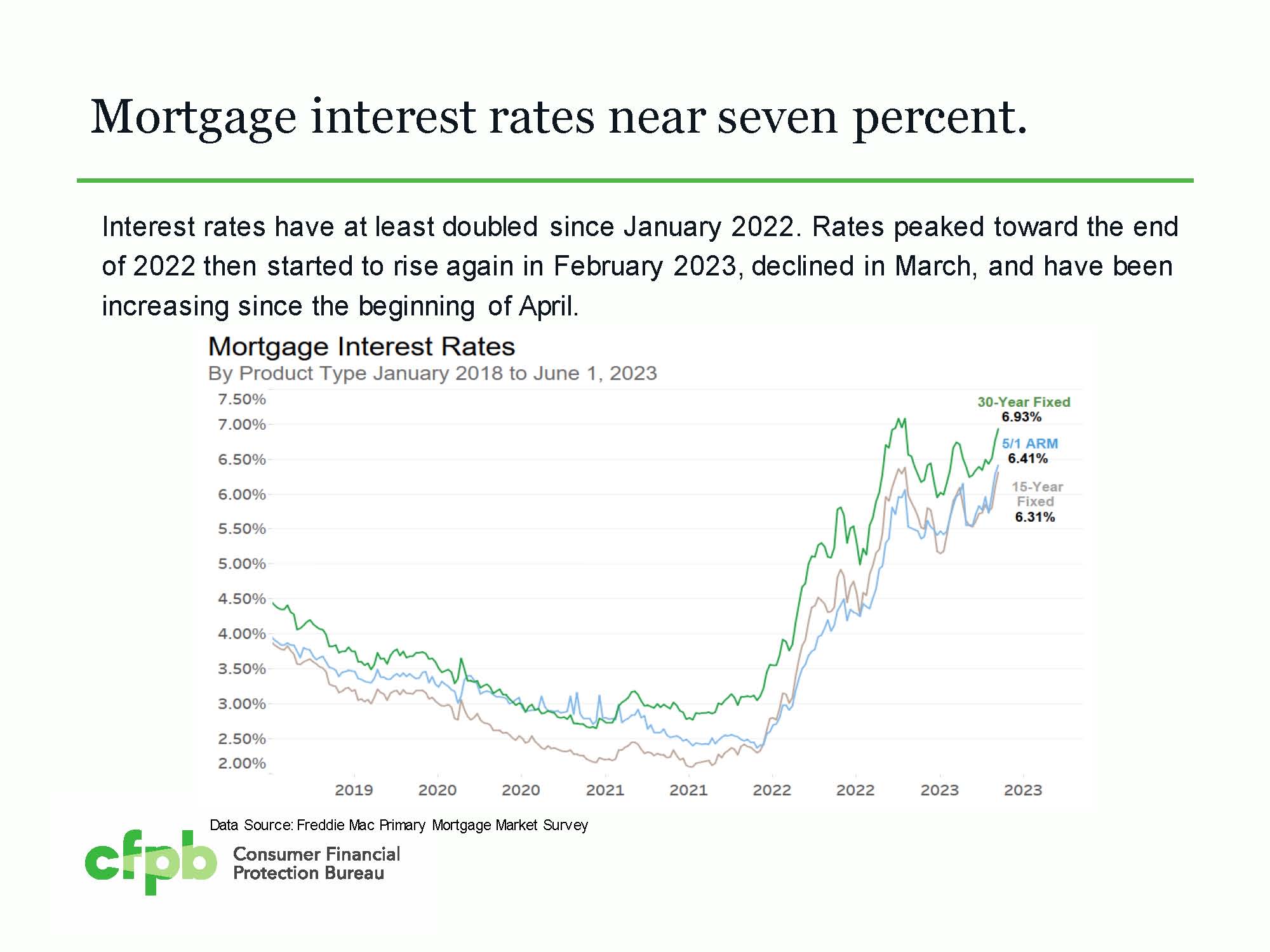

As the Federal Reserve (FR) increased both its short term cost of funds, and in March 2022 stopped purchasing Mortgage backed Securities, caused 30 year mortgage rates to rapidly rise from the 3's to as high as 7's. In recent FR conversations, they plan on keeping short term interest high for at least this year to bring down inflation, and have hinted at increases later this year. This will cause mortgage rates to either increase or remain near their current levels. Buyers will need to live with these rates until they are able to refinance in the future when rates are expected to recede.

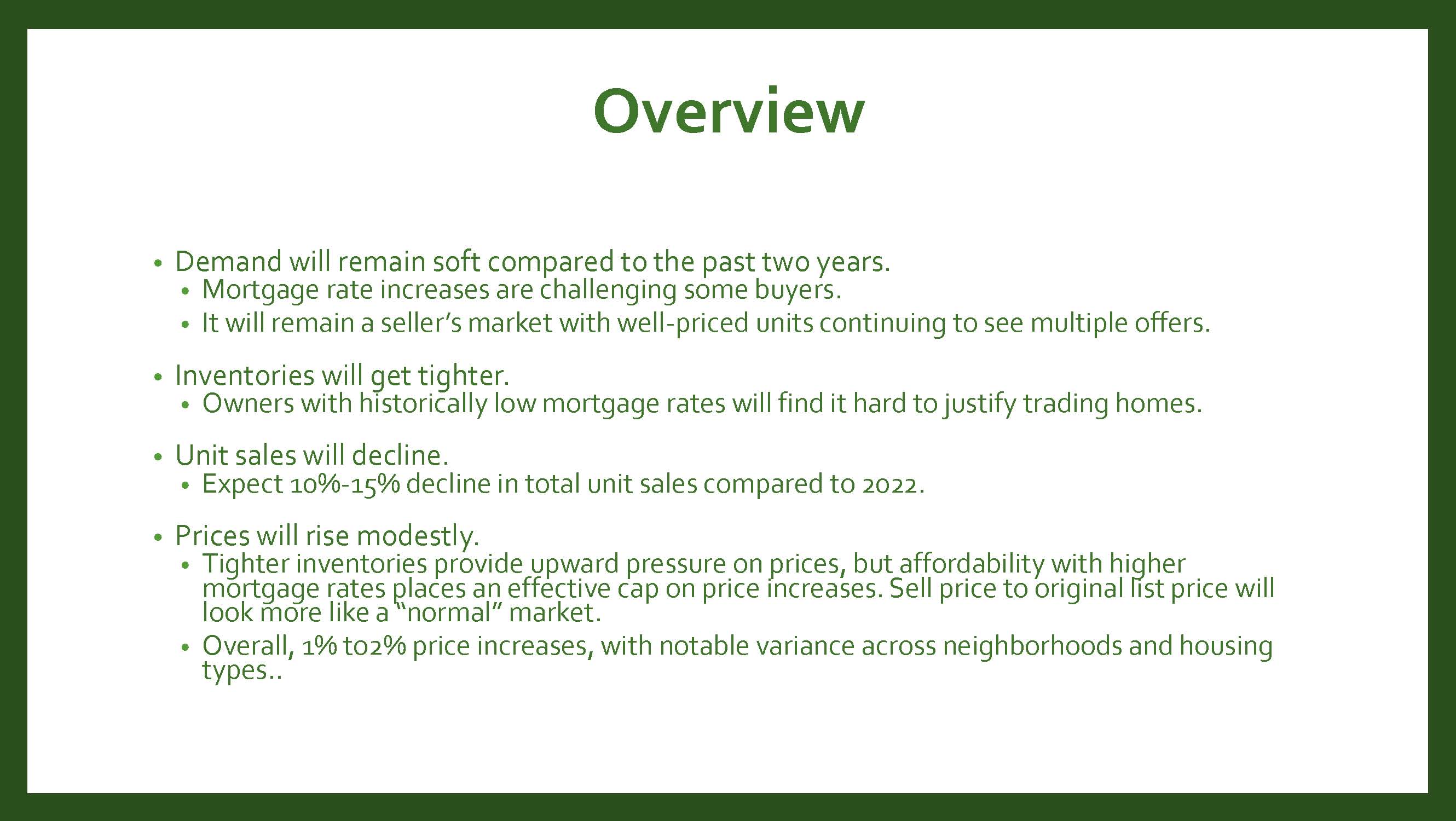

Although interest rates remain fairly high, which would normally cause pricing to go down, the lack of inventory, coupled with high demand is causing prices to actually rise slightly in 2023.

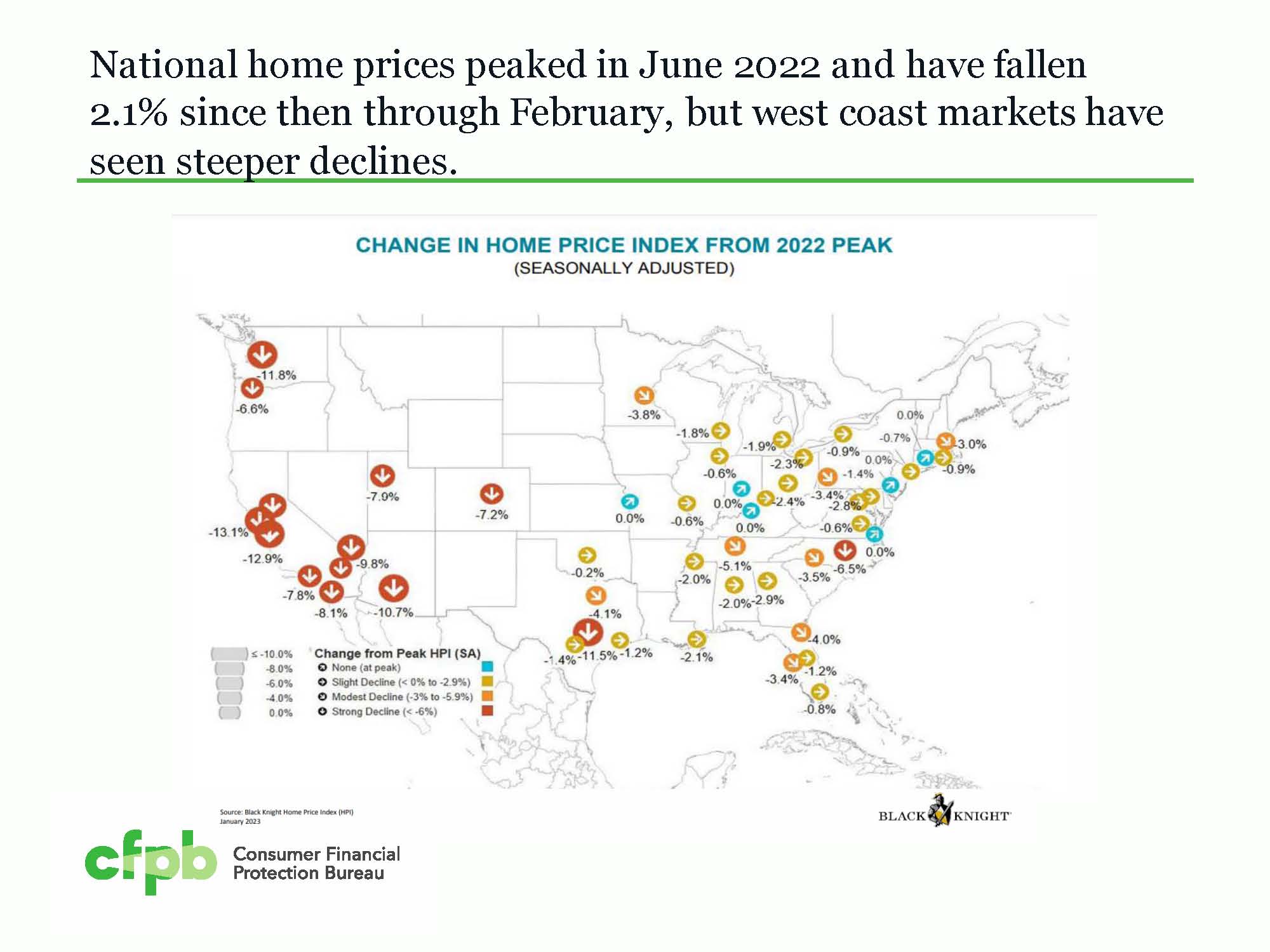

During 2022, prices increased for the first half, then those gains were eliminated by the end of the year. Some markets adjusted downward more than others. The Metro DC market saw some areas go down more than others.

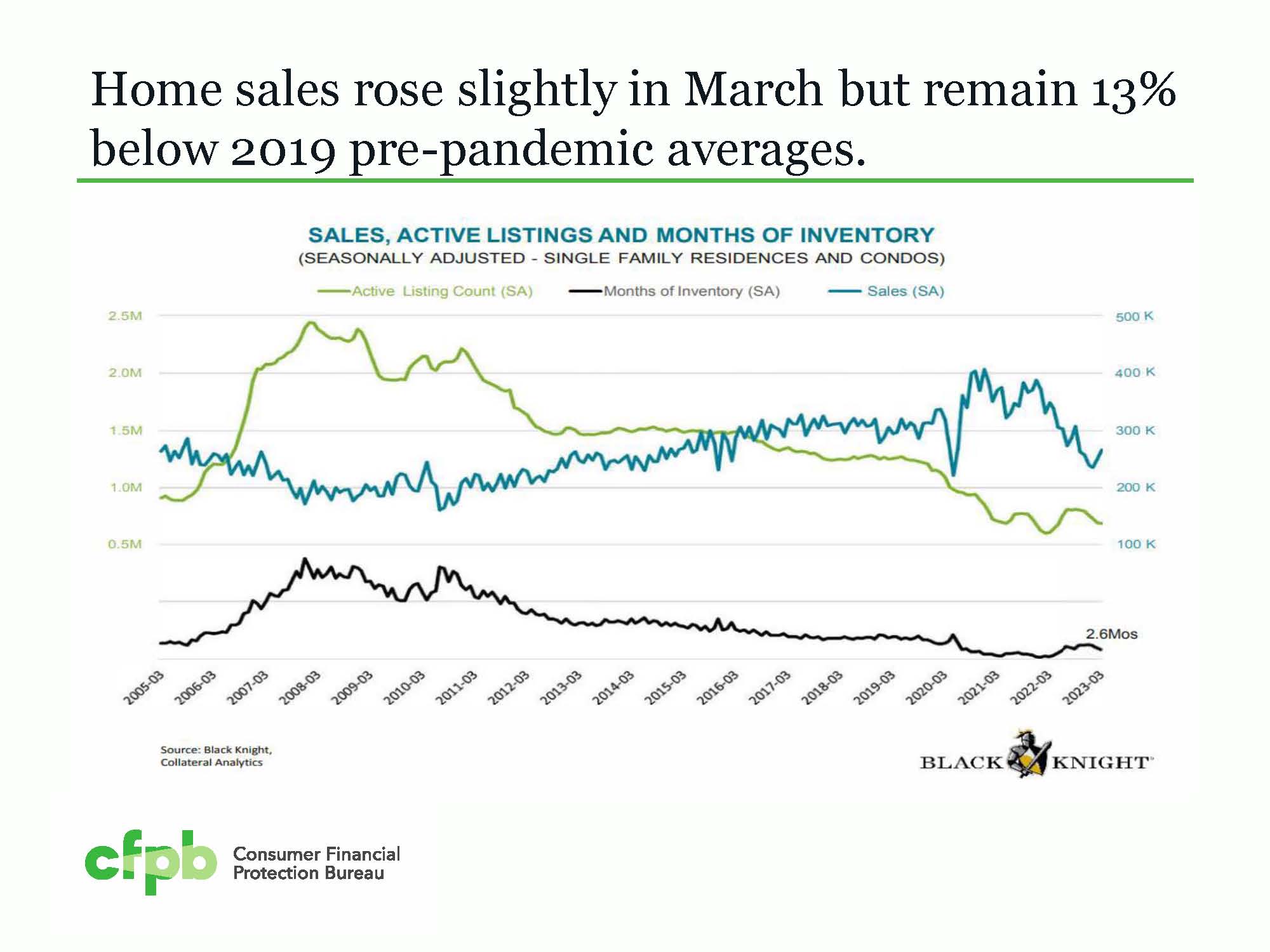

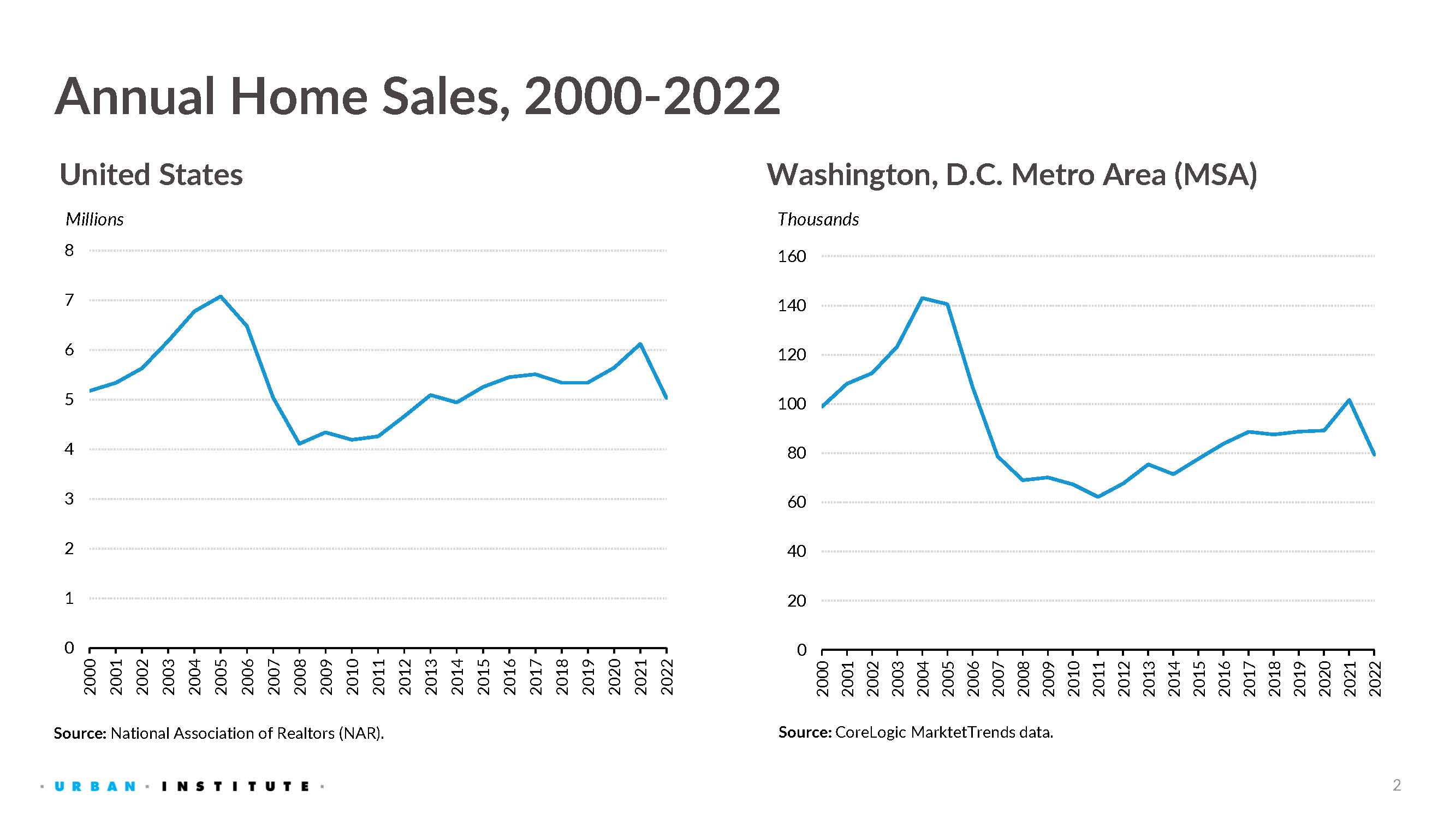

National and DC Metro residential real estate sales continue near the average level of the last 10 years.

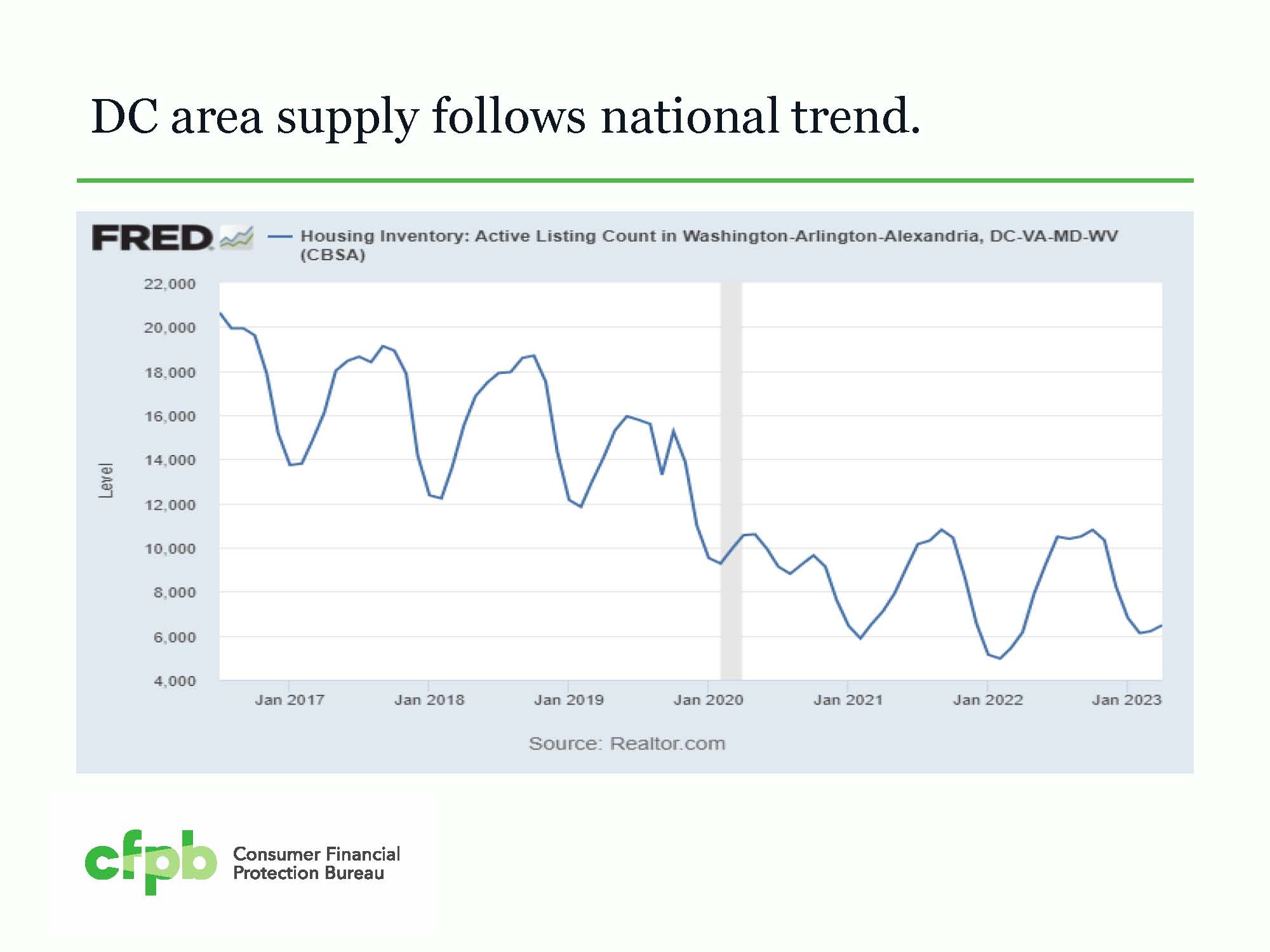

On a trended basis, DC Metro market has lost half its inventory in the past 5 years, the time wherein interest rates were low and probably more than 80% of the US mortgage holders refinanced, to take advantage of much lower interest rates.

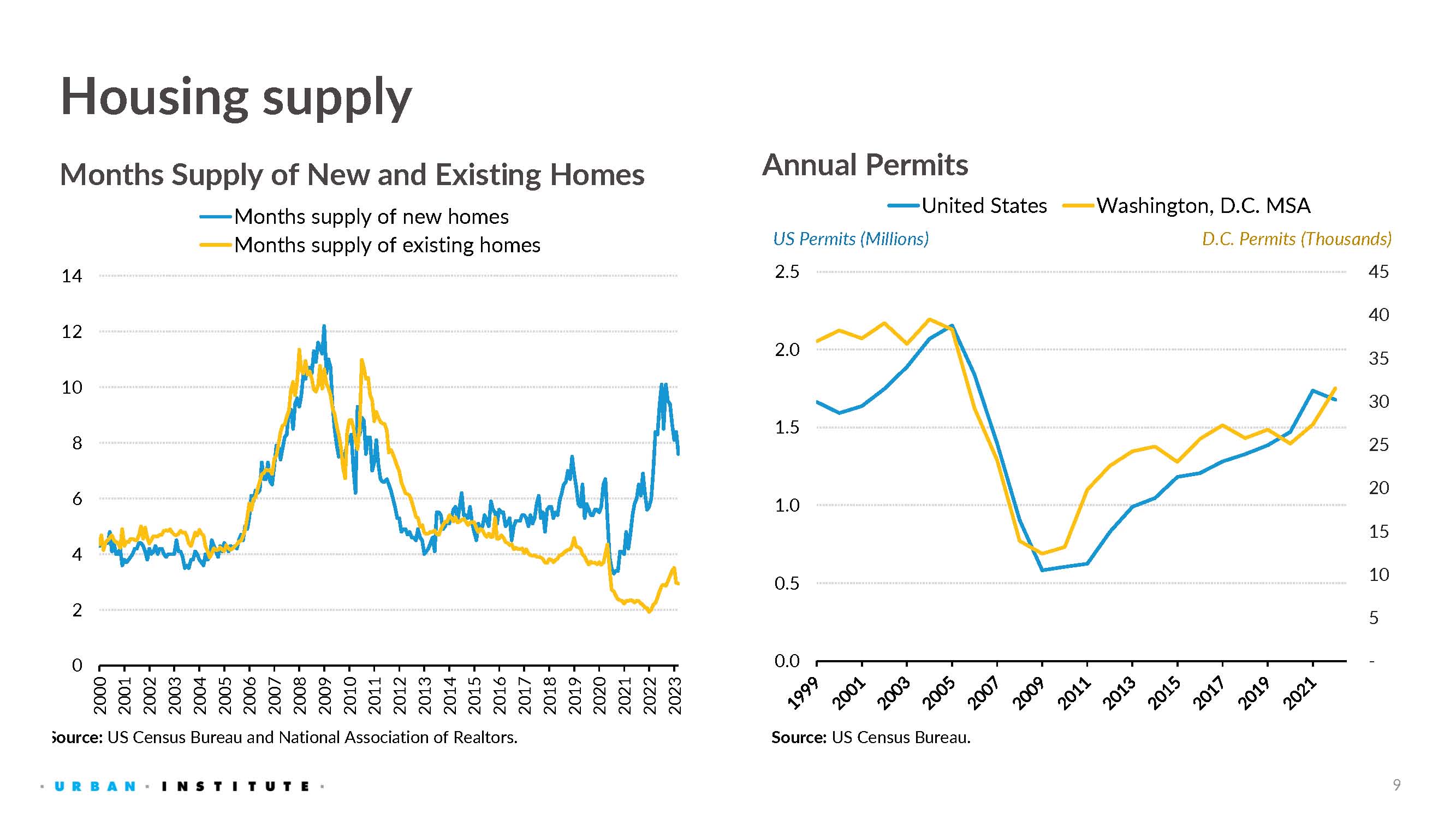

The Washington MSA identified a 151K housing shortage through 2019. At the same time, the Metropolitan Washington Council of Governments had forecasting done stating that "At least 320,000 housing units should be added in the region between 2020 and 2030. This is an additional 75,000 units beyond the units already forecast for this period." Considering the past 5 years have averaged around 28K new residential units built per year in DC Metro, means that unless there is a substantial increase in new construction, that the shortage will only continue, and may grow. This should maintain a sellers market for some time.

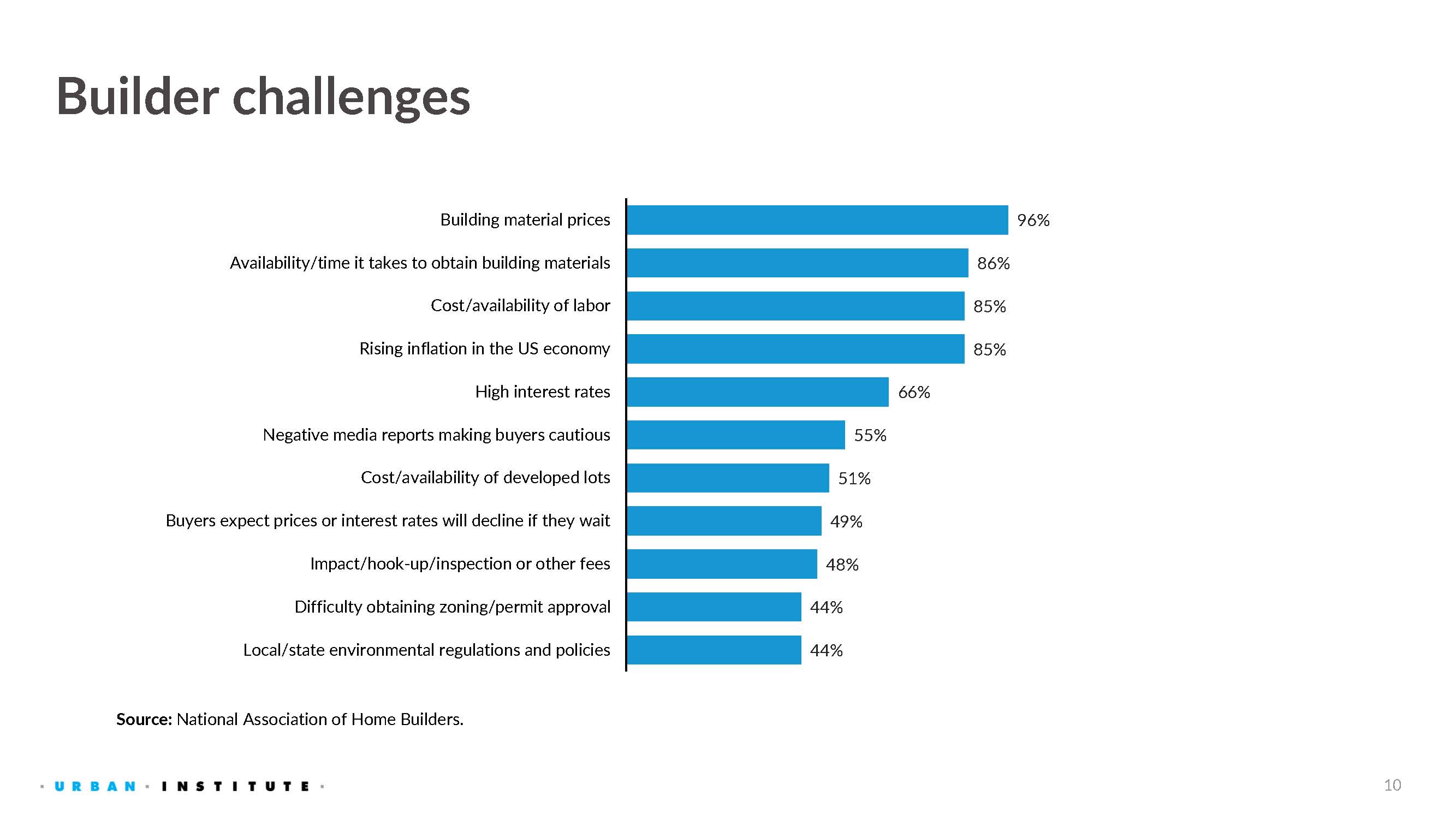

Builders cite the increased cost of materials, lack of work force and increased cost of short term capital as the reasons not to be able to build more. As the FR keeps interest rates high, and as major infrastructure projects over the next 10 years continue to pull at the work force, means that this problem is not going away.

Given the following, the real estate market should continue to do well for sellers. Buyers will remain with much competition for the limited inventory.